AR Accounts Receivables Aging

TodayPayments.com is the trusted

payment automation platform for businesses ready to upgrade how they

manage Accounts Receivable Aging. We specialize in digital

invoicing solutions, SMS and email notifications, and seamless batch

processing with ISO 20022 compliance. Whether you're a merchant,

bookkeeper, or finance team, we empower you with free, ready-to-use

templates and tools to simplify invoicing, reduce payment lag, and

reconcile faster. At TodayPayments.com, your overdue invoices

don’t stand a chance.

AR Aging Made Easy with Digital Invoicing & Messaging

Managing overdue invoices and improving cash flow

visibility is critical for any business. Traditional methods of

tracking Accounts Receivable (AR) Aging often involve

time-consuming manual work and fragmented communication. But with the

rise of digital invoicing, SMS notifications, and batch

uploads using ISO 20022 messaging, businesses can streamline the

entire AR lifecycle. From the moment an invoice is sent to the moment

it's reconciled with the bank, TodayPayments.com empowers

payees to take control using automated workflows, smart templates, and

rich data formats—completely free.

Accounts Receivable Aging (AR Aging) helps

businesses monitor outstanding invoices by age brackets (e.g., 15, 30,

60, 90+ days). By combining AR tracking with modern digital

invoicing tools, you can now:

- Send invoices through SMS, email, or text

- Automate reminders and follow-ups to reduce

DSO (Days Sales Outstanding)

- Maintain consistent communication from

Payee to Payer

- Include invoice aging data directly in your

message for clarity and urgency

No more guessing who owes what and when. AR Aging

+ Digital Invoicing gives you real-time financial control with less

friction.

Batch Uploads & Reporting with ISO 20022 Rich Data

Batch payment processing doesn’t have to be a headache.

TodayPayments.com simplifies bulk invoicing and reconciliation with

full support for ISO 20022 data messaging. Key features include:

- Batch Uploads: Instantly send multiple

invoices using XML, Excel, or JSON

- Downloadable Reports: Retrieve batch

results, aging reports, and payer responses

- Data-Rich Messaging: Include due dates,

invoice numbers, payer IDs, and itemized amounts

- Compliance-Ready: Format your files to meet

global banking and credit union standards

With structured messaging, reconciliation becomes

faster, and reporting becomes actionable.

Free AR Aging Worksheets & Reconciliation Templates

✅ "FREE" RfP Aging & Real-Time Payments Bank Reconciliation – with all merchants process with us.

Why start from scratch? TodayPayments.com

provides free, downloadable templates to give your business a head

start:

- Accounts Receivable Aging Worksheets –

Track overdue payments by date and amount

- Bank Reconciliation Templates – Match

payments to deposits and automate clearing

- ISO 20022 Sample Files – Get plug-and-play

file formats for uploads and testing

Our templates are designed for simplicity and scale—use

them for internal reporting or to interface with your accounting software

and payment platforms.

Managing Accounts Receivables

(AR) aging involves tracking and reconciling payments

received from invoices, FedNow, and RTP while ensuring

accurate matching, merging, and clearing of transactions.

Here's a step-by-step guide on how to handle AR aging using

these processes:

1. Invoice Generation and

Payment Recording:

- Invoice Generation:

- Generate and send

invoices to customers using your accounting

software.

- Payment Recording:

- Record payments

received from various sources (invoices, FedNow,

RTP) in your accounting system. Ensure accurate

entry of payment details (amount, date, etc.).

2. Matching Invoices and

Payments:

- Matching in QBO:

- Use QuickBooks Online

(QBO) features to match payments with corresponding

invoices. QBO typically has a built-in matching

process that uses criteria like invoice numbers,

customer names, or amounts.

- Excel Matching:

- If needed, use Excel's

MATCH function to manually match payments with

invoices based on common identifiers.

3. Merging Information:

- Data Collection:

- Collect payment data

from FedNow, RTP, and any other sources.

- Normalization:

- Ensure that data from

different sources is in a consistent format.

- Merging:

- Merge data from FedNow,

RTP, and other sources with your QBO data. Use

Excel or other tools to align and combine

information based on common identifiers.

4. Clearing Transactions:

- Reconciliation:

- Regularly reconcile

bank statements, QBO records, and external payment

data to identify discrepancies.

- Clearing in QBO:

- Use QBO's

reconciliation feature to clear transactions,

indicating that they've been verified against bank

statements.

5. AR Aging Analysis:

- Aging Categories:

- Set up aging categories

such as "Current," "1-30 Days," "31-60 Days," etc.,

based on due dates.

- Calculate Days Overdue:

- Calculate the days

overdue for each invoice using the due date and

current date in Excel.

- Categorize Aging:

- Use formulas to

categorize invoices into aging buckets based on the

number of days overdue.

6. Automation and Tools:

- Automation in QBO:

- Explore QBO's

automation features, including rules and batch

transactions, to streamline the matching and

clearing processes.

- Integration with FedNow

and RTP:

- If possible, integrate

QBO directly with FedNow and RTP for real-time

updates and reduced manual intervention.

7. Regular Reconciliation and

Documentation:

- Regular Reconciliation:

- Conduct regular

reconciliations to ensure accuracy between QBO,

bank statements, and external payment sources.

- Documentation:

- Maintain clear

documentation of reconciliations, adjustments, and

any discrepancies for audit purposes.

By following these steps, you

can effectively manage AR aging using the processes of

matching, merging, and clearing transactions when receiving

funds from various sources. Always refer to the latest

documentation and support resources provided by QBO for any

specific features or updates related to reconciliation

processes.

Don’t let overdue invoices drag your

business down. With TodayPayments.com, you can

easily send AR Aging notices via SMS, email, and text,

manage batch uploads using ISO 20022 messaging, and

reconcile your payments with free, professional-grade

templates.

👉 Start managing

receivables smarter, not harder.

🚀 Visit

https://www.TodayPayments.com to claim your free AR

Aging and reconciliation tools today!

How to AR Accounts Receivables Aging

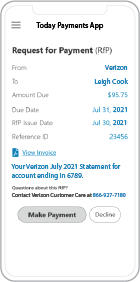

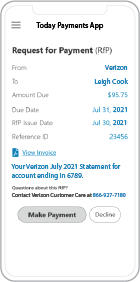

Request for Payment, a new standard for digital invoicing facilitating real-time payments RTP ® and FedNow ®

payments that are instant, final (irrevocable - "good funds") and

secure.

Request for Payment, a new standard for digital invoicing facilitating real-time payments RTP ® and FedNow ®

payments that are instant, final (irrevocable - "good funds") and

secure.

ACH and both FedNow Instant and Real-Time Payments Request for Payment

ISO 20022 XML Message Versions.

The versions that

NACHA and

The Clearing House Real-Time Payments system for the Response to the Request are pain.013 and pain.014

respectively. Predictability, that the U.S. Federal Reserve, via the

FedNow ® Instant Payments, will also use Request for Payment. The ACH, RTP® and FedNow ® versions are "Credit

Push Payments" instead of "Debit Pull.".

Activation Dynamic RfP Aging and Bank Reconciliation worksheets - only $49 annually

1. Worksheet Automatically Aging for Requests for Payments and Explanations

- Worksheet to determine "Reasons and Rejects Coding" readying for re-sent Payers.

- Use our solution yourself. Stop paying accountant's over $50 an hour. So EASY to USE.

- No "Color Cells to Match Transactions" (You're currently doing this. You won't coloring with our solution).

- One-Sheet for Aging Request for Payments

(Merge, Match and Clear over 100,000 transactions in less than 5 minutes!)

- Batch deposits displaying Bank Statements are not used anymore. Real-time Payments are displayed "by transaction".

- Make sure your Bank displaying "Daily FedNow and Real-time Payments" reporting for "Funds Sent and Received". (These banks have Great Reporting.)

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.